Angel investor tax credits in Iowa are going away

Iowa’s legislature needs to finish an easy fix for Iowa’s entrepreneurs

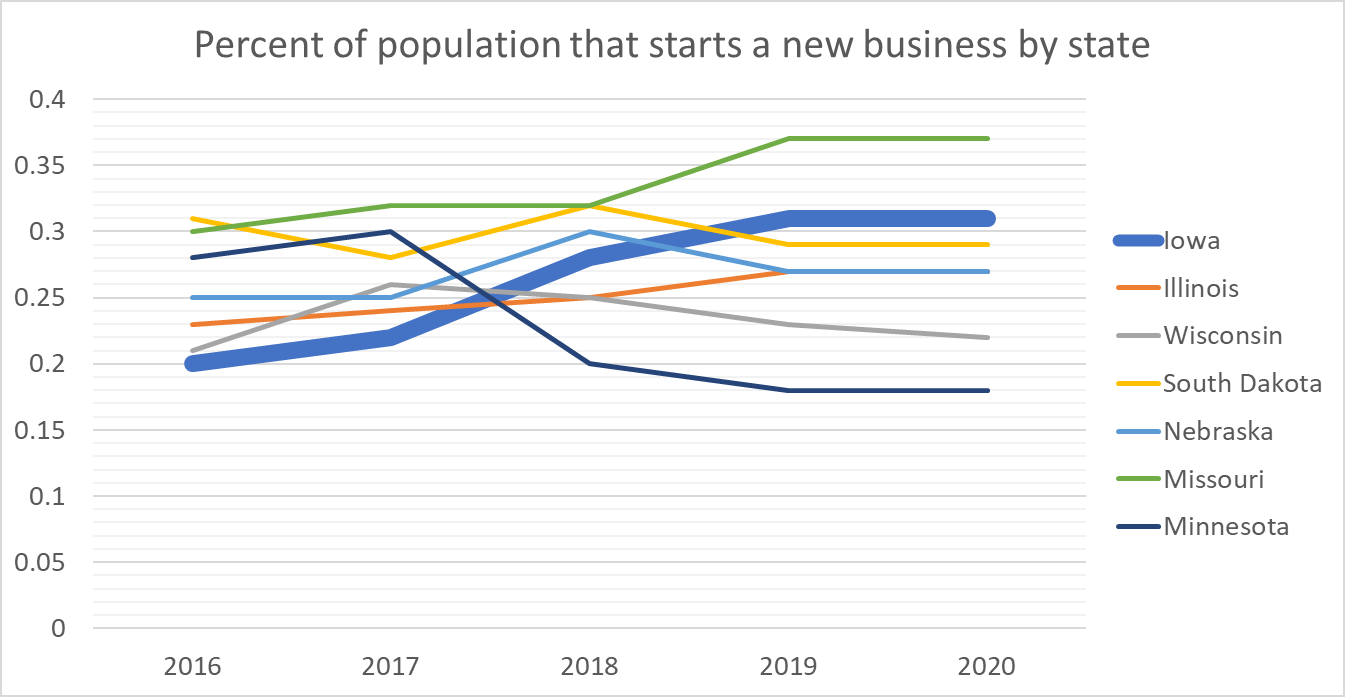

Iowa’s entrepreneurial community has been on a serious upswing in recent years. According to the Kauffman Foundation, in 2020, more Iowans formed new businesses per capita than all of our neighboring states except Missouri. And, Iowans are starting 50% more businesses per capita than we were just five years ago!

Source: Kauffman Foundation Indicators of Entrepreneurship, Rate of New Entrepreneurs

That blue line growing steadily since 2016 is not an accident. It is the result of many factors working together: the launching of a wide array of new programs to support entrepreneurs, new sources of capital, and new ways to organize investors and to incent them to invest in Iowa.

One way the state has supported entrepreneurs is by offering tax credits for investors who put early-stage capital into high-risk, Iowa-based startup businesses. This encourages Iowa investors to keep their money in-state, instead of investing in startups located in Silicon Valley or elsewhere.

There are companies all over the state who’ve used the program during their growth phases to attract high-risk investors. Together, they’ve created hundreds of jobs in Iowa - in our urban centers and in our small towns. And they are key to Iowa’s future growth.

However, this program is being halted because of the failure of Iowa’s legislators.

Here’s why. As our startup ecosystem has grown, so has demand for these tax credits. Years ago, Iowa’s legislature allocated a total of $10 million in tax credits per year for Iowa investors. However, that $10 million was split into two parts. $2 million per year was made available for individual angel investors, while the other $8 million was made available for investors in venture capital funds like Des Moines-based Next Level Ventures and Cedar Rapids-based ISA Ventures. These two funds - which only invest in Iowa companies - do not use their entire allocated amount, while angel investor demand far exceeds $2 million per year. This demand is so great that the Iowa Economic Development Authority (IEDA) has the angel investors on a waitlist for the next three years in order to claim their tax credits.

All of this means that:

several million dollars of tax credits per year are never used, and don’t accomplish their intended purpose;

the three year waitlist for credits isn’t effective at incenting Iowa’s angel investors;

startups in Iowa have a harder time than they should raising early stage capital.

A simple legislative code change - it is literally three pages long - would allow the IEDA to “load balance” the $10 million as needed between angel investors and the venture funds. In fact, this exact fix has been proposed in several recent legislative sessions. Despite bipartisan support and no opposition to this minor change, Iowa’s legislators have failed to act.

Because of this, the IEDA has suspended the program and will not accept any more applications for angel investor tax credits until the waitlist is cleared - about three years from now.

This is a huge step backward.

IEDA Director Debi Durham, along with business leaders across this state, have tirelessly courted startups and startup investors in Iowa to invest here, grow here, and migrate here. Iowa has tremendous momentum right now, our startup ecosystem has improved greatly. Neighboring states have their own angel tax credit programs to incentivize investment in startups and attract them to move and grow there. Let’s not lose the progress we’ve made in ensuring Iowa is the best place to start and grow a business.

This is an unforced error that is easy to fix. Our legislators need to step up and get it done. Please reach out to your legislators and urge them to pass Senate File 618 and ensure that the angel tax credits remain an asset for Iowa’s entrepreneurial community.

Eric Engelmann

General Partner, ISA Ventures

Tej Dhawan

Managing Director, Plains Angels

Craig Ibsen

Managing Partner, Next Level Ventures

Christopher Sackett

Attorney, Brown Winick

Nicole J. Gunderson

Managing Director, Global Insurance Accelerator

Managing Partner, Five Island Ventures